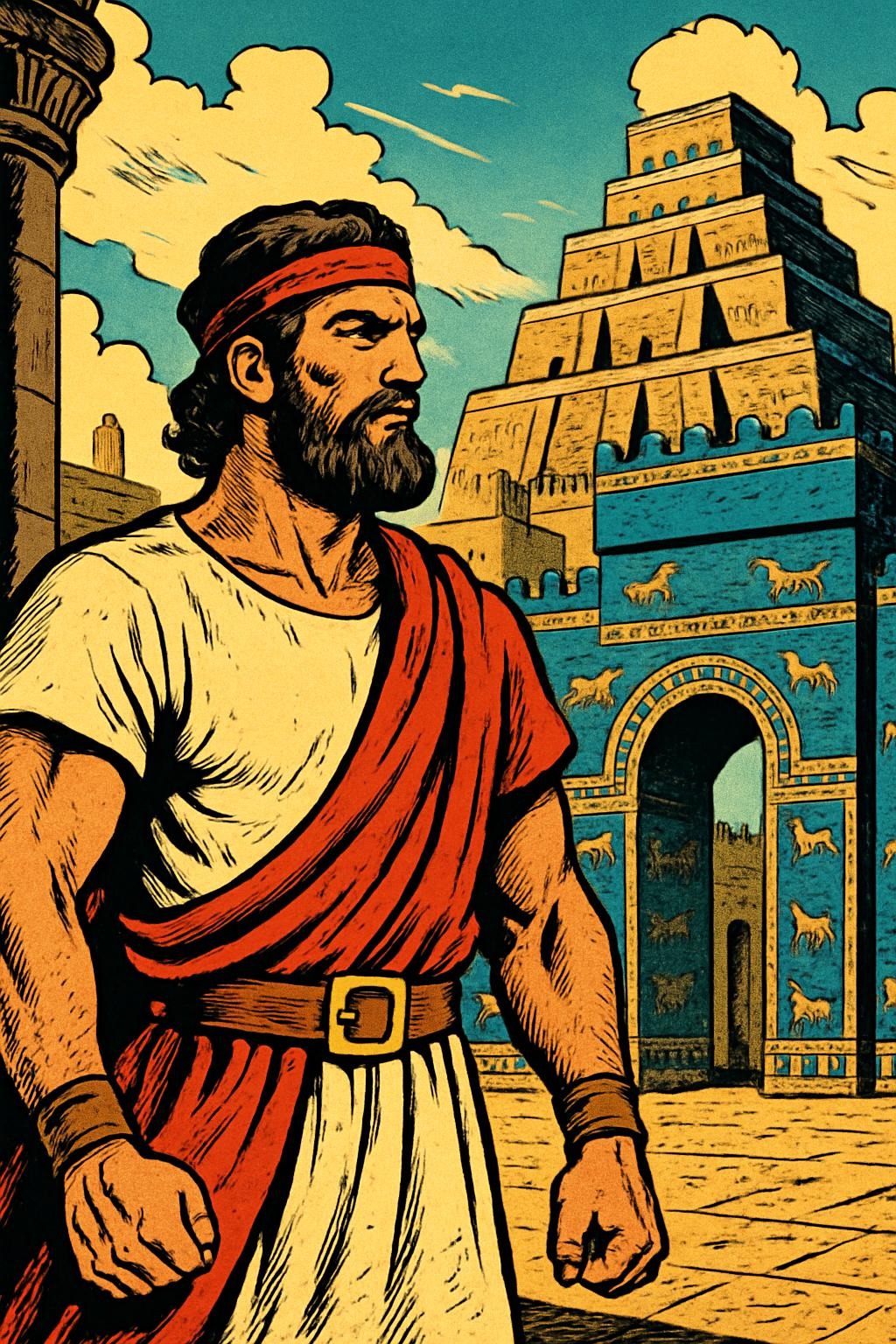

If you asked me to name a financial classic that has stood the test of time, The Richest Man in Babylon would be at the top of the list. First published as a series of pamphlets nearly a century ago, it continues to sell in the millions. Why? Because the challenges it describes—the struggle to save, the weight of debt, the pursuit of financial security—are as real today as they were in ancient Babylon. The book opens with vivid imagery of a city that could just as easily be modern London, New York, or Tokyo. The setting may be ancient, but the lessons are timeless. And if your ambition is to build your first 100K, you’d be hard-pressed to find a more practical guide.

Why This Matters

Many people chase complex strategies, chasing after the next big investment or the latest money-making trend. But building wealth rarely starts with complexity—it starts with discipline. This book strips finance down to its bare essentials and reminds us of something crucial: your first 100K isn’t about luck. It’s about margin, habits, and mindset.

For me, one of the most powerful lessons came from the story of Dabasir, a man shackled by debt who became a slave. Debt had him by the throat—until he decided to take responsibility and work his way out. That image crystallised something I had long felt but hadn’t defined: debt is a shackle. It restrains your freedom and your future. I applied this to my own mortgage, choosing to pay it off aggressively. The sense of control that comes from tackling debt head-on is liberating. For anyone pursuing their first 100K, understanding that freedom from debt is as valuable as the wealth itself is a game-changer.

Breaking Down the Lessons

Curiosity as the Spark

The book begins with two men lamenting their financial situations. One wants to borrow, the other cannot lend. But instead of sinking into despair, they take action. They seek out Arkad—the richest man in Babylon—to understand how he built his fortune. That decision to get curious is the spark. It’s also the same spark that leads someone today to pick up a finance book, to search for investment strategies, or even to read this blog. Without curiosity, there is no journey to 100K.

Arkad’s Three Principles

Early on, Arkad sets the foundation with three deceptively simple lessons:

- Live upon less than you earn. You cannot build wealth without margin. If your outgoings consume your income, your 100K will forever remain out of reach.

- Seek advice from those with experience. Don’t take investment advice from people who haven’t achieved what you’re striving for. I’d rather listen to someone who has already hit their 100K than someone simply managing other people’s money.

- Make your gold work for you. In modern terms: invest wisely. Even small sums compound over time, provided you start early and remain consistent.

The 7 Cures for a Lean Purse

If the book has one section worth memorising, it’s this. The 7 cures are as relevant today as they were in Babylon:

- Fatten your purse. Keep at least 10% of what you earn. This is non-negotiable. Without savings, your 100K is a fantasy.

- Control your expenses. Yes, you can spend the remaining 90%, but spend it wisely. Lifestyle creep is the enemy of margin.

- Make your gold multiply. Invest your savings so that money begins to work for you, rather than the other way round. A simple 7% return compounds into financial independence if you stay the course.

- Guard your treasures. Avoid reckless speculation. Seek counsel from those with proven experience.

- Make your home a profitable investment. In some cases, home ownership reduces expenses and builds long-term stability.

- Ensure a future income. Plan for retirement, because building the first 100K is not the finish line—it’s the launchpad.

- Increase your ability to earn. Develop your skills, add side incomes, and continuously expand your earning power. Personally, I’ve done this by widening my IT skills and diversifying my streams of income.

Of all the cures, the first—fattening your purse—is the cornerstone. If you can’t save 10% consistently, you’ll never break free of financial struggle. That single habit is the lever that moves everything else.

The Camel Trader of Babylon

The story of Dabasir, once again, reinforces the destructive power of debt. It’s not just about numbers; it’s about identity and integrity. A man in debt is not free. He must take control, repay faithfully, and refuse to let debt define him. For modern readers, whether it’s credit cards or student loans, the lesson is clear: debt is a chain, and paying it off is an act of freedom.

The Letter of Mr. Shrewsbury

Towards the end, we find a letter from an archaeologist applying Babylon’s lessons in his own life. His 70-20-10 system (70% for living, 20% for paying debts, 10% for savings and investment) is as practical today as it was in the story. Swap expensive teas, downsize accommodation, cut excesses—but never cut the habit of saving. That’s how wealth is built.

Final Thoughts and Action Steps

Nearly 100 years after its publication, The Richest Man in Babylon remains a 10/10 book in my view. Its strength lies in its simplicity. Powerful stories combined with practical, timeless financial advice—it’s a winning formula. For anyone aiming at their first 100K, this isn’t just a book. It’s a blueprint.

So, what should you do with this knowledge?

Question for reflection: Which of the 7 cures can you start applying today?

Challenge for action: This week, set aside 10% of your income. Don’t touch it. Don’t excuse it. Make it the cornerstone of your journey toward the first 100K.

Because building wealth isn’t about getting lucky—it’s about taking the right steps, consistently, over time. Start with one, and soon you’ll be on the road to your first 100K.

Leave a Reply