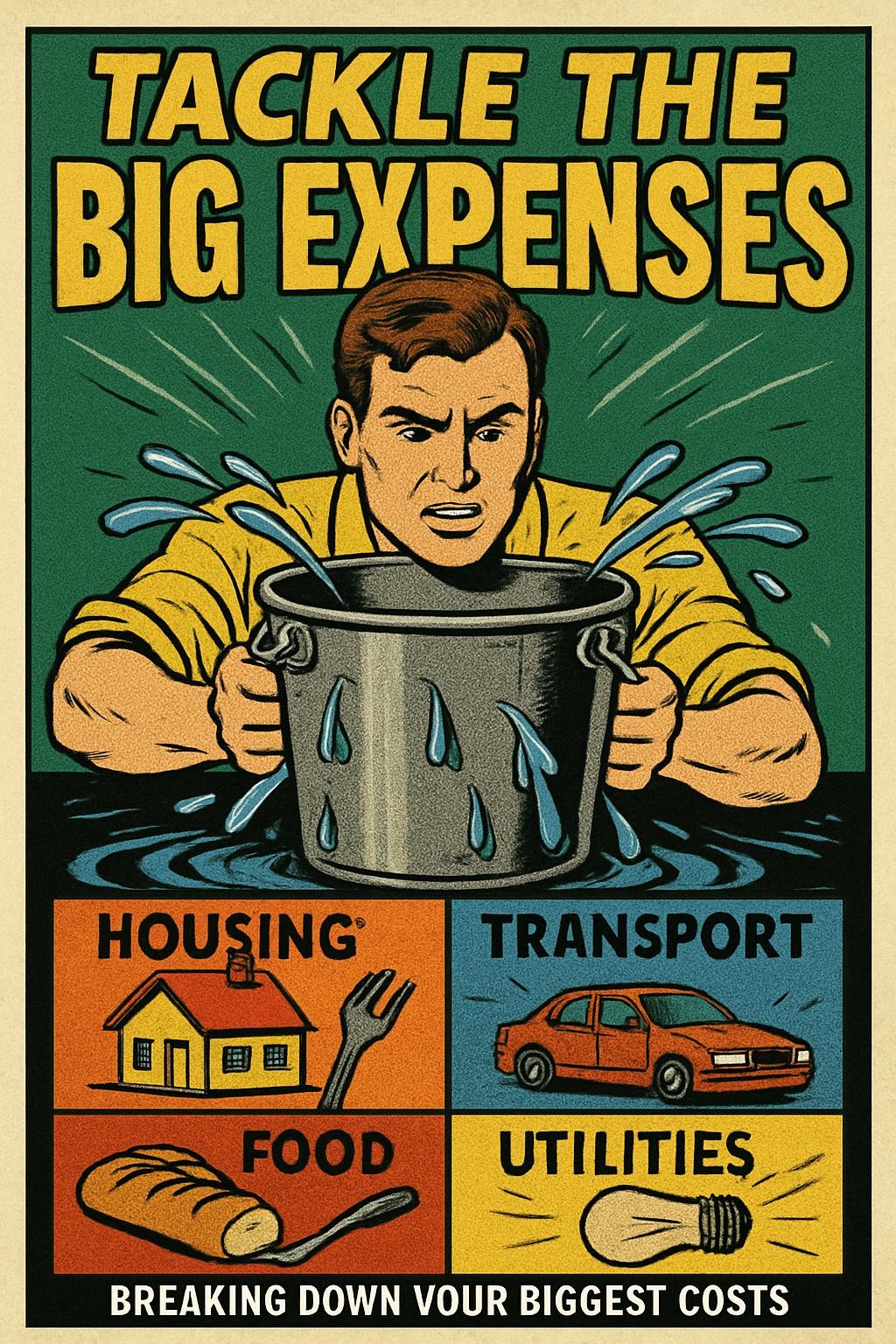

Most people think saving money means saying no to everything that makes life enjoyable—no dinners out, no coffees, no holidays. But here’s the truth: you don’t need to sweat the small stuff to hit your financial goals. The fastest way to build momentum towards your first 10K is to tackle the big expenses.

Housing. Transport. Food. Utilities. These four categories eat up most of your income, and they’re where the biggest opportunities to cut costs—without cutting quality of life—can be found. Get these right, and you’ll unlock thousands a year in savings. Get them wrong, and no amount of “latte factor” advice will save you.

Let’s break it down.

Why This Matters

Think of your finances as a bucket. If the bucket has small leaks (the odd takeaway coffee, a streaming service you’ve forgotten to cancel), yes, you’ll lose a bit of water. But if there’s a massive hole in the side (high rent, a flashy car lease, overpaying for utilities), you’ll never fill the bucket, no matter how disciplined you are.

By focusing on the largest outflows, you make progress faster. This is how you go from struggling to save a few pounds here and there, to putting aside thousands each year without feeling deprived. And if you can do that while still enjoying the things you love? You’re setting yourself up for sustainable, long-term success.

Housing: Your Biggest Lever

For most people, housing is the single biggest expense—often 30–40% of income. It’s also the area where a smart decision can completely transform your financial trajectory.

When I was renting, my monthly costs looked like this:

- Rent: 400

- Bills: 200

Later, I bought a place. My new costs:

- Mortgage: 300

- Bills: 250

On paper, owning was only marginally cheaper. But it made sense for me, because I was investing into an asset. Of course, the numbers don’t tell the whole story—there were closing costs, solicitor fees, and bank charges. That’s why my number one rule is: always run the numbers.

If you’re younger, house-sharing is an unbeatable option. Not only does it slash costs, it gives you flexibility and the chance to build your network. And if you’re looking to buy, don’t fall into the trap of thinking ownership is always better. Sometimes, renting is smarter. Sometimes, relocating to a cheaper area can unlock savings of 20–40% without meaningfully lowering your quality of life.

The point is: don’t let housing “just happen” to you. Decide on it strategically.

Transport: Smart Moves Over Flashy Cars

The second big expense is transport. The right strategy depends heavily on where you live.

If you’re in a city, public transport usually wins. No insurance, no parking, no constant trips to the petrol station. The savings add up quickly, and the convenience is hard to beat.

If you’re in a rural area, a car might be unavoidable. But here’s where many people go wrong: they treat their car as a status symbol instead of a utility. A reliable, economical car is more than enough. Choosing wisely here can save you thousands over a five-year period.

Consider these real-world savings:

- Dropping a second household car often frees up 3–5K a year.

- Switching from leasing new cars to owning reliable older models can cut transport costs in half.

Your car shouldn’t be the thing that’s keeping you from building wealth.

Food: Eat Well, Spend Less

Food is the category that often feels like it should be smaller than it is. Yet for many households, it’s a top-three expense.

Here’s how I approach it: lifestyle adjustments, not penny-pinching. I cook at home most of the time, and when I do, it usually covers multiple meals with leftovers. I eat out once a week—it still feels like a treat, without becoming a financial drain.

I once gave up my favourite pizza and fried chicken takeaway. That decision alone saved me around 30 a week—about 1500 a year. The payoff wasn’t just financial; my waistline and my energy levels thanked me too.

The key lesson? Food is one of the easiest places to overspend without realising it. But with a little planning—meal prepping, cooking more, and limiting takeout—you can save hundreds a month while eating better than before.

Utilities: Hidden Costs That Add Up

Utilities are less glamorous than cars or housing, but they can quietly drain hundreds every year. A few smart tweaks go a long way.

Here are some of my own strategies:

- Switch gas and electric providers every two years. It’s the first, easiest win.

- Use a clothes horse instead of a tumble dryer. Better for your clothes, better for your wallet.

- Buy your phone outright and go SIM-only. This saves 200–300 over a standard two-year contract, and if you keep your phone longer, the savings double. (Fun tip: a new phone case can make your device feel brand-new.)

- Avoid internet providers that lure you in with low introductory rates, only to hike the price later. I’d rather pay a fair, stable rate than play games with “special offers.”

- For heating, I wear jumpers in spring and autumn, and in winter I run the central heating twice a day, supplementing with a space heater to warm the room I’m actually in.

Even small adjustments here add up. A household that switches energy providers regularly can save 300–600 annually without lifting a finger beyond the initial setup.

Knowing What to Cut (And What Not To)

Here’s where people go wrong: they cut costs randomly, rather than strategically.

I use the MoSCoW method:

- Musts: non-negotiable basics—housing, bills (after optimisation), groceries.

- Shoulds: things that improve your life or finances—savings, investments.

- Coulds: discretionary spending. You choose what matters.

- Wants: fantasies that can wait.

This framework makes the process less emotional and more objective. For example, I realised my post-gym smoothie wasn’t a “must”—it was just a habit. I took a different route home, and suddenly the craving vanished.

Another tip: go through your bank statement. If you can’t remember what an expense was, it’s probably not worth keeping. Those forgotten purchases are where easy wins hide.

Common Pitfalls in Cost Cutting

There are a few traps I see people fall into again and again:

- Cutting too shallow: Skipping coffees but ignoring housing costs.

- Rebounding: Being ultra-frugal for a month, then splurging triple the next month.

- Mistaking wants for needs: Believing you “need” that takeaway or subscription.

The fix is simple: identify what you truly value and keep that. Cut aggressively everywhere else. This way, you still enjoy life, but you keep moving towards your first 10K.

Quick Win: Take Control Now

If you do one thing after reading this post, do this: check your bank statement.

Yes, it might feel uncomfortable at first. But awareness is half the battle. The very act of observing your spending changes your behaviour. You’ll notice patterns, spot wasted cash, and start making different decisions—without even forcing it.

That’s your placebo effect: by paying attention, you automatically start to save.

Questions for You

- Which of your big four (housing, transport, food, utilities) could make the biggest difference if you tackled it today?

- What’s one expense you could cut this week that wouldn’t affect your happiness?

- What’s one expense you’d never cut, no matter what—and how will you protect it by cutting elsewhere?

- Have you run the numbers on your current living situation? Could relocating, downsizing, or sharing be worth it?

- Will you commit to reviewing your bank statement this week and cutting just one forgotten expense?

Leave a Reply