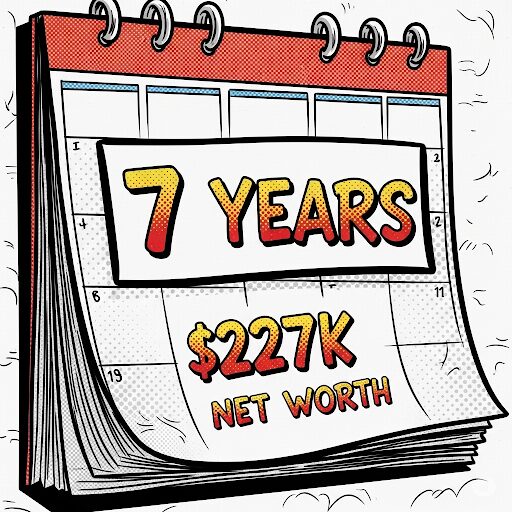

How I Grew My Net Worth Over 7 Years — And Why Investing Is My Passion

If you’ve ever watched your investment account drop and felt a wave of panic, I want you to know something important: your net worth is more than a number on a screen, and losing access to your investments doesn’t mean losing your wealth. I know this because I’ve lived it — and thrived through it.

Over the past 7 years, I’ve grown my net worth from £16,000 to over £227,000. That growth wasn’t linear, and it certainly wasn’t glamorous, but it taught me lessons about money, investing, and patience that I now share with readers at The Next 100K — my site dedicated to helping people build wealth sustainably while enjoying the process of investing.

Starting building wealth: Learning the Hard Way

I began my journey in August 2018 with about £16,000. Like many beginners, I made some rookie mistakes. My first investments were in actively managed funds, chosen because they sounded smart and professional. Thankfully, I quickly realized the fees and complexity weren’t working in my favor. Over time, I simplified everything: low-cost index funds, one provider, fewer funds. Investing became less stressful, more transparent, and ultimately more effective.

Consistency became my cornerstone. Every month, I contributed a percentage of my income — about 10% — into my investments. I also made it a habit to sweep leftover cash into my portfolio. This disciplined, boring approach created a strong foundation for wealth.

The Big Decision: Selling £51,000 for a Home

In December 2023, my portfolio peaked at £51,000. I faced a choice many investors fear: sell a large chunk of investments or carry a massive mortgage. I chose to sell.

Yes, being out of the market was daunting, but I also crystallized gains I had worked hard to achieve. I used the money to buy a house and fund renovations — investing not in stocks, but in my life. Once I moved in, I had the headspace to think clearly about the next steps, and I reinvested £11,000 left over from renovations back into the market.

There was no alternative — selling was the most straightforward way to fund the purchase — and it taught me an important lesson: sometimes the best investment is in your stability, not the market.

Net Worth vs Portfolio: The Bigger Picture

One of the biggest misconceptions I see is equating portfolio balance with wealth. Your net worth — everything you own minus what you owe — matters far more. That includes your pension, property, cash, and investments.

After selling my portfolio, my net worth was safe, even if my brokerage account read zero. That realization changed how I make financial decisions: I focus on total wealth, not day-to-day market fluctuations. Real assets like property and pension contributions became part of my strategy, smoothing out volatility and giving me confidence to continue investing.

Staying Consistent Amid Market Noise

Even as my portfolio fluctuated, some things didn’t change:

- Automated monthly contributions continued.

- Spare cash always found its way into investments.

- I ignored market hype and news, focusing on long-term growth.

I experimented briefly with portfolio allocations for a few months, but the core strategy — disciplined contributions into low-cost funds — proved to be the winner. Dollar-cost averaging removes hesitation, fear, and the need to “time the market,” which is exactly how I steadily grew wealth over 7 years.

Lessons I’ve Learned From Building Wealth

- Track your net worth, not just your portfolio. Wealth is a holistic concept.

- Big life investments aren’t setbacks. Funding stability sometimes outweighs small market gains.

- Consistency beats timing. Regular contributions compound faster than chasing perfect moments.

- Investing can be joyful. When approached with curiosity and discipline, it becomes more than a numbers game — it’s a path to financial freedom.

A simple spreadsheet became my best friend, helping me track growth across accounts, property, and pensions. Seeing the bigger picture is empowering, and that’s what I want readers at The Next 100K to experience: investing as both strategy and passion.

Ask Yourself

- If your investments dropped to zero tomorrow, would your total net worth survive?

- Are you tracking all your assets, or just your brokerage account?

- Is your strategy building long-term stability, or just chasing portfolio numbers?

Today, my net worth is £227,024, and my portfolio continues to grow. More importantly, I’ve learned that the true measure of investing isn’t the number in your account — it’s whether your wealth grows over time, even through life’s ups and downs.

Leave a Reply